Decarbonization Through Renewable Energy Certificates: Asia-Pacific Market Outlook 2025–2032 | DataM Intelligece Report

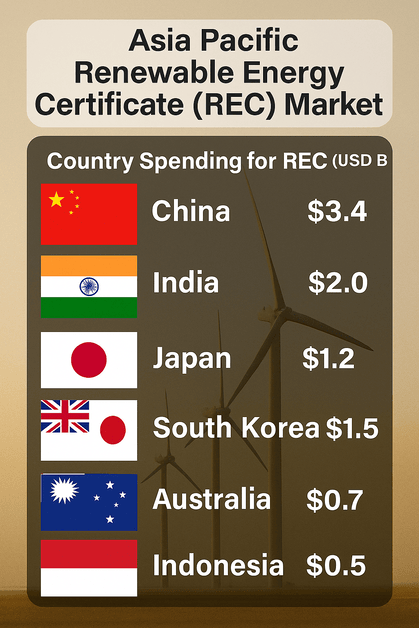

Country-Specific Snapshot

Asia-Pacific REC market is surging as corporates pursue net-zero goals. Key trends, risks, and strategies shape the 2025–2032 outlook.

AUSTIN, TX, UNITED STATES, July 14, 2025 /EINPresswire.com/ -- Renewable Energy Certificates: A Corporate Decarbonization Lever

As global enterprises sharpen their focus on ESG metrics, carbon neutrality, and Scope 2 emissions reduction, Renewable Energy Certificates (RECs) have become essential instruments in environmental accounting. A REC certifies that one megawatt-hour (MWh) of electricity was generated from an eligible renewable source and fed into the grid. This decouples the environmental attributes of power from its physical delivery, enabling corporates to claim renewable consumption even when direct access is limited.

Across Asia-Pacific, the REC ecosystem is transitioning from compliance-centric trading mechanisms to voluntary corporate procurement platforms that support net-zero goals, RE100 commitments, and science-based targets. In markets like India, Japan, Australia, and China, RECs are increasingly integrated into corporate energy procurement strategies as they offer flexibility, traceability, and third-party verifiability of renewable energy use.

Download Exclusive PDF Sample Report: https://www.datamintelligence.com/download-sample/asia-pacific-renewable-energy-certificate-market

Market Growth Acceleration and Structural Shifts

Expansion Trajectory

The Asia-Pacific REC market is anticipated to grow at a CAGR of nearly 10% between 2025 and 2032, outpacing other global regions. This growth is underpinned by an accelerating deployment of renewable energy capacity, government-backed clean energy finance, and expanded access to third-party certificate platforms.

China alone is expected to account for over USD 4 billion in REC demand by 2032, while India, Japan, and South Korea are establishing structured mechanisms for utility-scale issuance, trading, and retirement of certificates.

Supply Overhang and Price Dynamics

The region faces a paradox: while corporate demand is rising, renewable generation is scaling even faster. The oversupply of green certificates could drive average REC prices down by 70–80% from their current levels, reaching as low as USD 11–12 per MWh by 2050. For corporates, this may lower the cost of compliance and voluntary renewable claims—but also creates uncertainty around long-term incentive viability for new renewable projects.

National Markets: Structural Highlights

• India: A reformed REC regime with perpetual validity and deregulated pricing has reactivated trading volumes. India’s market saw over 25% growth in REC issuance during FY24, driven by policy clarity and increasing corporate procurement.

• China: The government-issued Green Energy Certificate (GEC) is the dominant instrument. International RECs are being phased out, making local certification essential for compliance with national carbon reporting frameworks.

• Japan: Fragmented certificate types exist, but only certain non-FIT (Feed-in Tariff) RECs meet international standards. As a result, corporates are adopting virtual PPAs (VPPAs) or shifting to global I-REC mechanisms to ensure disclosure credibility.

• South Korea: Companies can acquire RECs through green pricing schemes, direct PPAs, or market purchases. However, inconsistencies around project additionality and contract tenures continue to deter multinational procurement.

• Australia: Voluntary REC uptake is accelerating, supported by robust tracking infrastructure. Despite high renewable penetration, corporate buyers prefer bundled energy + REC deals through energy retailers.

• Southeast Asia (Vietnam, Malaysia, Indonesia): Markets are nascent but growing. Vietnam offers some of the region’s lowest REC prices, while Malaysia is piloting cross-border trade under a regulatory sandbox.

Ask For Customized Report as per Your Business Requirement: https://www.datamintelligence.com/download-sample/asia-pacific-renewable-energy-certificate-market

Barriers to Scale and Strategic Risks

While the growth narrative is strong, several strategic challenges remain for corporates:

• Fragmented Regulatory Architecture: REC schemes remain country-specific with differing issuance, tracking, and validity standards. This limits regional integration and hinders multinationals operating across Asia.

• Market Liquidity Constraints: In emerging markets, trading platforms lack depth, and transaction costs remain high, especially for SMEs seeking to claim renewable use under sustainability frameworks.

• Additionality Concerns: Some RECs, particularly from legacy assets, lack environmental additionality, raising greenwashing concerns and reputational risks for buyers using these in ESG disclosures.

• Volatility in REC Pricing: As supply increases, pricing becomes unpredictable, complicating long-term procurement strategy and contract valuation.

• Infrastructure Gaps: Weak transmission systems, grid intermittency, and limited access to advanced metering can delay REC issuance and verification.

Strategic Imperatives for Corporate Leaders

For decision-makers overseeing sustainability portfolios, energy procurement, or investor relations, the following imperatives should guide REC strategy in Asia-Pacific:

A. Future-Proof Energy Procurement

• Build blended procurement portfolios combining on-site generation, direct PPAs, and third-party I-RECs.

• Structure contracts to hedge against price volatility and secure forward REC commitments.

B. Align with Regional Initiatives

• Monitor progress of ASEAN power trade integration and regional REC platforms under initiatives like the ASEAN RECAP.

• Engage with local regulators and standards bodies to influence harmonization of certification mechanisms.

C. ESG Risk Mitigation

• Prioritize RECs from new renewable projects to strengthen claims of additionality.

• Audit all certificate attributes for issuer credibility, location, vintage, and impact metrics.

• Integrate REC retirement with internal ESG dashboards to support auditability and investor reporting.

D. Capitalize on Oversupply Opportunities

• Utilize the declining cost of RECs to meet internal decarbonization targets more cost-effectively.

• Consider strategic accumulation of low-cost RECs during supply peaks to support future sustainability milestones.

E. Support Innovation in Tracking & Transparency

• Invest in digital REC platforms that offer blockchain-based traceability, automated compliance reporting, and smart contract integration.

• Leverage AI-driven certificate analytics for optimizing procurement across jurisdictions and scopes.

The ESG Advantage in Pharma and Industrial Sectors

For pharmaceutical and manufacturing sectors in particular, REC integration is becoming a standard ESG expectation:

• Scope 2 emissions account for a large share of facility-based energy use (e.g., HVAC systems, cleanroom operations, refrigerated supply chains).

• REC-backed renewable procurement not only supports ESG disclosures but also reduces regulatory risk tied to carbon border taxes and trade compliance.

• As supply chains globalize, pharmaceutical leaders must ensure that all international sites maintain parity in renewable usage reporting.

Conclusion

The Asia-Pacific Renewable Energy Certificate market offers abundant opportunities-but demands strategic alignment, market literacy, and risk-aware procurement. As energy transparency, investor expectations, and ESG regulation tighten, corporate leaders must move beyond compliance to create resilient, credible renewable energy strategies rooted in REC markets.

Unlock 360° Market Intelligence with DataM Subscription Services Specially Designed for Energy Sector: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights-all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ Technology Road Map Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

✅ Consumer Behavior & Demand Analysis

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Sai Kumar

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release