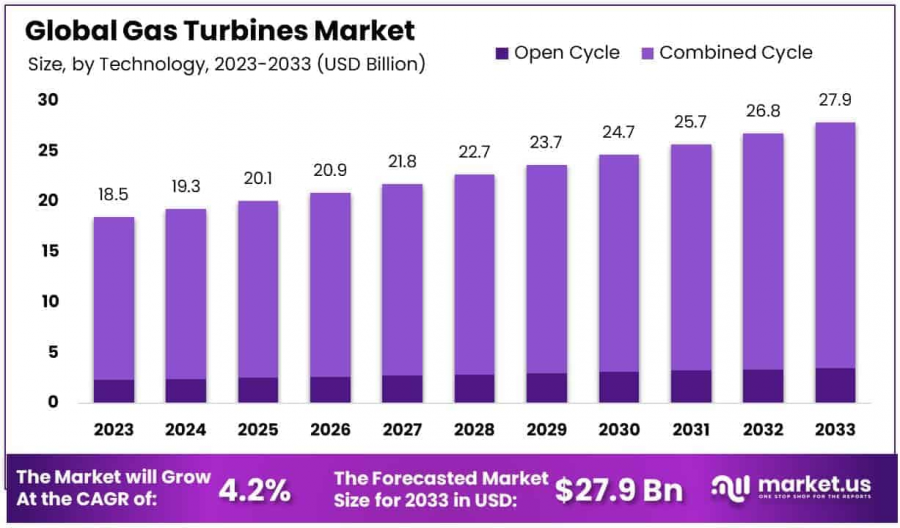

Gas Turbine Market to Reach USD 27.9 Billion by 2033, Growing at a 4.20% CAGR from 2024

Gas Turbine Market size is expected to be worth around USD 27.9 Billion by 2033, from USD 18.5 Billion in 2023, growing at a CAGR of 4.20%

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- Report Overview

Gas turbines are combustion engines that convert chemical energy from fuel into mechanical energy to generate power. They operate by compressing air, mixing it with fuel, and igniting the mixture to produce high-temperature, high-pressure gases that drive turbine blades. Gas turbines are widely used in power generation, aviation, and industrial applications due to their high efficiency, reliability, and ability to operate on multiple fuel sources.

The gas turbines market refers to the global industry involved in the manufacturing, distribution, and deployment of gas turbine systems across various applications. This market is driven by increasing demand for efficient power generation technologies, growth in industrialization, and the expansion of aviation fleets. The market is segmented based on technology (open cycle and combined cycle), capacity, application (power generation, oil & gas, aviation), and fuel type (natural gas, oil, and hydrogen-based turbines).

The gas turbines market is experiencing significant growth due to rising energy demand and the shift toward cleaner energy sources. The increasing adoption of natural gas-fired power plants as a replacement for coal-based energy generation is a major driver. Additionally, advancements in turbine efficiency and the development of hydrogen-powered turbines are further boosting market expansion.

Growing electricity consumption, particularly in emerging economies, is a key factor driving demand for gas turbines. Countries are investing in grid expansion projects and combined cycle power plants, which offer higher efficiency and lower emissions. The aviation industry’s continuous expansion and modernization efforts also contribute to the demand for gas turbines.

Opportunities in the gas turbine market include the integration of digital technologies such as IoT and AI for predictive maintenance and performance optimization. Additionally, decarbonization initiatives and government support for hydrogen-based power generation present lucrative growth avenues for market players.

Key driving factors include stringent emission regulations, the transition from coal to natural gas, and technological innovations in turbine design. The increasing focus on energy efficiency and renewable energy integration with gas turbine technology also enhances market prospects.

Get a Sample PDF Report: https://market.us/report/gas-turbine-market/request-sample/

Key Takeaway

• The Global Gas Turbine Market size is expected to be worth around USD 27.9 Billion by 2033, from USD 18.5 Billion in 2023, growing at a CAGR of 4.20% during the forecast period from 2024 to 2033.

• In 2023, Heavy-duty Gas Turbines held a dominant market position in the by-type segment of the Gas Turbine Market, with a 52.4% share.

• In 2023, Above 300 MW held a dominant market position in the By Capacity segment of the Gas Turbine Market, with a 36.6% share.

• In 2023, Combined Cycle held a dominant market position in the By Technology segment of the Gas Turbine Market, with an 87.4% share.

• In 2023, Power and Utilities Aviation held a dominant market position in the end-use segment of the Gas Turbine Market, with a 48.3% share.

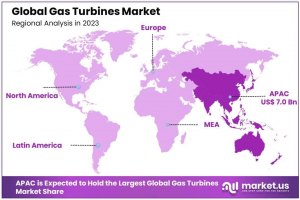

• Asia Pacific dominated a 38.2% market share in 2023 and held USD 7.0 Billion in revenue from the Gas Turbine Market.

Gas Turbines Market Segment Analysis

By Type Analysis

In 2023, Heavy-duty Gas Turbines dominated the Gas Turbine Market’s "By Type" segment with a 52.4% share, driven by their high capacity and durability for large power plants. Industrial Gas Turbines catered to mid-sized applications, valued for flexibility and quick start-up. Aero Derivative Gas Turbines, adapted from jet engines, excelled in rapid load changes and emergency power needs. The distinct advantages of each type highlight the market’s diverse demand across industries, emphasizing efficiency and technological advancements.

By Capacity Analysis

In 2023, the Above 300 MW segment led the Gas Turbine Market’s "By Capacity" category with a 36.6% share, driven by its role in large-scale utility projects requiring high power output and efficiency. Less than 40 MW turbines served small-scale applications, while 40–120 MW and 120–300 MW segments catered to intermediate needs in medium-sized plants. This segmentation highlights gas turbines' diverse applications, with Above 300 MW turbines playing a crucial role in global energy infrastructure and large metropolitan power supply.

By Technology Analysis

In 2023, Combined Cycle dominated the Gas Turbine Market’s "By Technology" segment with an 87.4% share, leveraging its dual-phase operation of gas and steam turbines to enhance efficiency and reduce emissions. Open Cycle technology, though less efficient, remains relevant for quick power supply in peak load and remote applications due to its lower cost and fast start-up. The strong market preference for Combined Cycle reflects a global shift toward energy-efficient and eco-friendly solutions, driving its adoption in large-scale power projects.

By End-Use Analysis

In 2023, Power and Utilities Aviation led the Gas Turbine Market’s "By End-Use" segment with a 48.3% share, driven by its critical role in power generation and aviation applications. The Oil & Gas sector heavily relies on gas turbines for exploration and pipeline operations, while the Manufacturing sector values their efficiency in energy-intensive processes. The Others category covers smaller-scale applications. The dominance of Power and Utilities Aviation highlights the essential role of gas turbines in infrastructure and energy reliability.

Buy Now: https://market.us/purchase-report/?report_id=22290

Key Market Segments

By Type

• Heavy-duty Gas Turbines

• Industrial Gas Turbines

• Aero Derivative Gas Turbines

By Capacity

• Less than 40 MW

• 40–120 MW

• 120–300 MW

• Above 300 MW

By Technology

• Open Cycle

• Combined Cycle

• By End-Use

• Power and Utility Aviation

• Oil & Gas

• Manufacturing

• Others

Top Emerging Trends

1. Shift Toward Hydrogen-Based Gas Turbines: The gas turbine market is witnessing a major shift toward hydrogen-based turbines as industries and governments push for low-carbon energy solutions. Companies are investing in hydrogen-compatible turbines to reduce emissions and comply with global sustainability goals. Advances in hydrogen combustion technology are making these turbines more efficient and reliable. This trend is driven by climate policies, increasing investments in renewable energy integration, and efforts to decarbonize power generation.

2. Increased Adoption of Digital Twin Technology: Digital twin technology is revolutionizing gas turbine operations by enabling real-time monitoring and predictive maintenance. These virtual models simulate turbine performance, helping operators optimize efficiency, reliability, and lifespan. The integration of AI and IoT in digital twins enhances decision-making, reduces downtime, and improves operational safety. As power plants and industries focus on reducing maintenance costs, this technology is becoming a game-changer. The demand for smart, data-driven turbine management is expected to rise, making digital twins an essential tool in modern power infrastructure.

3. Growing Demand for Hybrid Power Systems: Hybrid power systems combining gas turbines with renewables are gaining traction due to their flexibility and reliability. These systems help balance fluctuating renewable energy sources, ensuring continuous power supply. Battery storage integration with gas turbines further enhances grid stability. Governments and industries are increasingly investing in hybrid solutions to meet decarbonization goals while maintaining grid resilience. As energy transitions accelerate, gas turbines will play a key role in bridging the gap between fossil fuels and renewable energy, ensuring stable power generation.

4. Focus on Efficiency Through Advanced Materials: Manufacturers are exploring advanced materials like ceramic matrix composites (CMCs) to improve turbine efficiency. These materials withstand higher temperatures, reducing the need for cooling and enhancing fuel efficiency. The use of 3D printing is also enabling lighter and more durable components, optimizing performance. Higher efficiency leads to lower emissions and operational costs, making these advancements crucial for the future of gas turbines.

5. Expansion of Distributed Power Generation: The rise of distributed energy systems is driving demand for smaller, flexible gas turbines that provide localized power generation. Industries, commercial facilities, and remote areas are adopting microturbines and small gas turbines to ensure energy security and reduce dependence on central grids. These turbines are particularly valuable in developing regions, where access to stable electricity remains a challenge. With the increasing push for energy independence and decentralized grids, distributed gas turbines will play a key role in shaping the future energy landscape.

Regulations on the Gas Turbine Market

The gas turbine market is subject to stringent regulations worldwide due to environmental concerns, safety requirements, and energy efficiency standards. Governments and regulatory bodies impose emissions limits to curb greenhouse gas output, particularly nitrogen oxides (NOx) and carbon dioxide (CO₂).

Agencies such as the Environmental Protection Agency (EPA) in the U.S. and the European Commission’s Industrial Emissions Directive (IED) enforce strict emission norms, requiring gas turbine manufacturers to develop low-emission combustion technologies.

Safety regulations also play a crucial role, with organizations like the Occupational Safety and Health Administration (OSHA) and the International Organization for Standardization (ISO) setting design, operation, and maintenance standards. ISO 3977 outlines performance and reliability criteria for gas turbines, ensuring efficiency and safe operation.

Energy policies influence market dynamics by promoting cleaner alternatives. Many governments offer incentives for combined cycle gas turbines (CCGTs) that enhance efficiency while reducing emissions. Moreover, grid integration policies, renewable energy targets, and carbon pricing mechanisms indirectly affect gas turbine deployment.

Stringent fuel regulations also shape the market, with restrictions on sulfur content in natural gas and liquid fuels. These policies drive technological advancements in turbine materials, cooling techniques, and digital monitoring solutions to ensure compliance while maintaining performance.

Regional Analysis

The global gas turbine market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting unique market dynamics. Asia Pacific leads the market with a 38.2% share, valued at USD 7.0 billion, driven by rapid industrialization, rising energy demand, and substantial infrastructure investments in economies like China and India.

North America benefits from stringent environmental regulations and aging power plant upgrades, boosting the adoption of efficient gas turbines. Europe sees steady growth due to a strong regulatory framework promoting energy efficiency and emissions reduction, alongside an increasing integration of renewables.

In the Middle East & Africa, demand is rising due to expanding industrial sectors and abundant natural gas resources, while Latin America, though a smaller market, experiences gradual growth from energy infrastructure modernization and efficiency improvements.

Overall, the global gas turbine market remains robust, with Asia Pacific at the forefront due to expanding energy capacity and technological advancements, while other regions focus on regulatory compliance, infrastructure upgrades, and industrial efficiency to drive market expansion.

Key Players Analysis

◘ Siemens

◘ General Electric

◘ Wärtsilä

◘ Mitsubishi Heavy Industries Ltd

◘ Opra Turbines

◘ Kawasaki Heavy Industries, Ltd.

◘ Solar Turbines Incorporated

◘ Bharat Heavy Electricals Limited (BHEL) Harbin Electric Corporation Co., Ltd.

◘ MAN Energy Solutions

◘ VERICOR

◘ UEC Saturn

◘ Zorya-Mashproekt

◘ Baker Hughes Company

◘ Capstone Green Energy Corporation

◘ Ansaldo Energia

◘ Nanjing Turbine & Electric Machinery

Recent Developments of the Gas Turbines Market

— In June 2023, Siemens announced a global investment plan of €2 billion to expand its manufacturing capacity, including €200 million for a new high-tech plant in Singapore and €140 million to enlarge a facility in Chengdu, China.

— In 2023, BHEL secured a contract to supply equipment for a 105 MW power plant in Bangladesh, contributing to the country's energy infrastructure.

Strategic Initiatives

— Product Portfolio Expansion: Companies are investing in R&D to develop advanced formulations that meet regulatory and consumer demands.

— Geographic Expansion: Focus on high-growth regions like Asia-Pacific and the Middle East to capitalize on industrialization trends.

— Sustainability Initiatives: Efforts to align with global sustainability goals and minimize environmental

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release