In this week’s newsletter, we will take a quick look at some of the critical figures and data in the energy markets this week.

We will then look at some of the key market movers early this week before providing you with the latest analysis of the top news events taking place in the global energy complex over the past few days. We hope you enjoy.

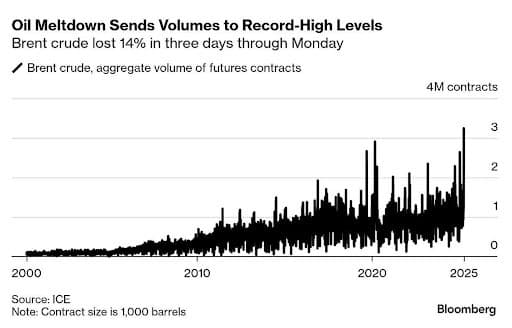

US-China Tariff Wars Trigger Largest Brent Sell-off Ever

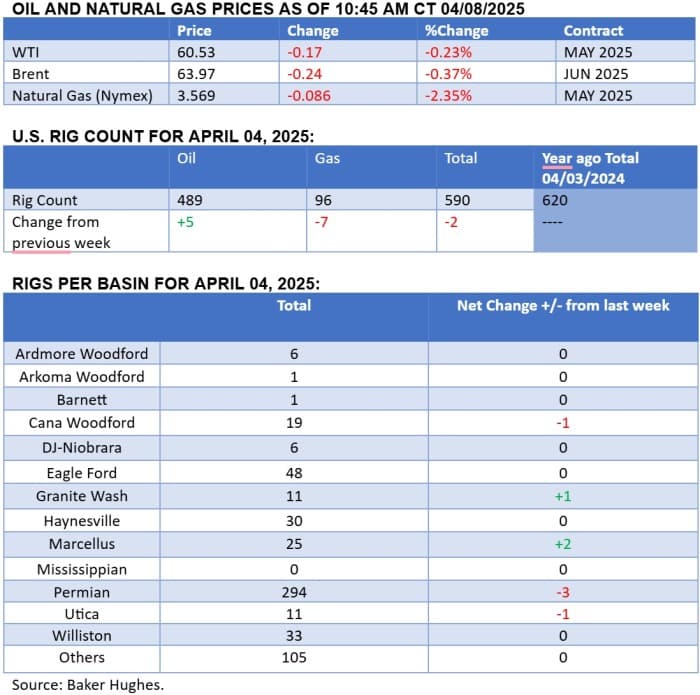

- Crude markets have experienced an unprecedented rout of investors as ICE Brent futures posted the highest ever daily traded volume on April 7, trading more than 3 million lots, more than triple the usual daily volume.

- Further complicating matters, all regional oil benchmarks remain firmly backwardated with the Brent M1-M2 spread still trading around $0.50 per barrel, despite prices plunging some $10 per barrel in three days.

- US investment firm revamped its near-term pricing forecasts and now expects Brent and WTI prices to be at $62 and $58 per barrel, respectively, by December 2025, only to lose further $7 per barrel next year.

- Amidst industry calls to tame US tariff warfare, further downward corrections could be expected in 2025 demand numbers, with the EIA already delaying its monthly report to April 10, citing the need to re-run its models to account for a more hostile economic environment.

Market Movers

- Australia’s largest oil producer Woodside Energy (ASX:WDS) said it agreed to sell a 40% stake in its Driftwood LNG project in Louisiana to US infrastructure investor Stonepeak for $5.7 billion.

- Top EV battery maker CATL (SHE:300750) is reportedly in talks to buy a controlling stake in the power unit of Chinese carmaker Nio (NYSE:NIO), seeking to expand into charging and battery swapping services.

- Colombia’s state-controlled oil firm Ecopetrol (NYSE:EC) is considering buying the country’s largest independent oil producer SierraCol Energy, owned by private equity firm Carlyle Group, for some $1.5 billion.

- Italy’s oil major ENI (BIT:ENI) disclosed that it is looking at further divestments of its upstream assets on the back of its $1.65 billion West Africa deal with global trading house Vitol.

Tuesday, April 08, 2025

Battered by the market-wide sell-off, oil prices managed to halt their decline on Tuesday with ICE Brent recovering slightly to $65 per barrel. However, the US-China trade war could degenerate further with US President Trump threatening further tariffs on China, potentially negating and overwhelming whatever positive moves have been made vis-à-vis South Korea or Japan. Therefore, the short-term outlook remains bearish with investors wary of taking any new positions.

Trump Vows to Lift China Tariffs Higher. US President Donald Trump announced that if Beijing does not withdraw its 34% import tariff on US goods, the White House will impose an additional 50% tariff on the Asian country with immediate effect from April 09, taking China’s tariff rate to 104%.

Saudi Aramco Slashes Crude Prices. Amidst a worsening US-China trade war and continued OPEC+ unwinding, Saudi national oil company Saudi Aramco (TADAWUL:2222) has lowered its Asian formula prices for May-loading cargoes with an across-the-board cut of $2.30 per barrel.

Sanctions Help to Improve OPEC+ Compliance. Declines in Iranian and Venezuelan oil production on the heels of tightening US sanctions led to a drop in OPEC oil production in March, with the oil group’s members pumping 26.63 million b/d last month, down 110,000 b/d vs February levels.

London Mulls Oil Product Tariffs. The UK government, seeking to respond to US President Trump’s 10% import tariff on the country, is considering the inclusion of refined products in its retaliatory tariffs, sourcing a quarter of its diesel import requirements from the US Gulf Coast.

US Gas Weighed Down by Tariff Woes. The May contract of US benchmark Henry Hub futures dipped to $3.74 per mmBtu, the lowest close in almost eight weeks, despite forecasts of colder weather coming across the States, mostly due to concerns of recession halting gas demand growth.

Panama Canal Eyes a New LPG Pipeline. The Panama Canal Authority opened a bidding process for a new pipeline that could transport liquefied petroleum gas across the waterway, potentially speeding up deliveries of US propane to Japan and South Korea, a voyage that now takes up to 35 days.

Libya to Offer PSAs in New Bidding Round. The government of Libya is offering production sharing agreements to oil majors bidding into its first licensing round since 2008, offering higher returns to investors as the North African country seeks to boost production to 2 million b/d.

Chevron to Rebuild the Louisiana Coast. US oil major Chevron (NYSE:CVX) was ordered to pay $740 million to restore damages caused by Texaco, a company it bought in 2001, to Louisiana’s coastal wetlands after it failed to clear, revegetate and detoxify its exploration sites.

Canada Makes U-Turn on New Oil Projects. Since the departure of former Prime Minister Justin Trudeau, oil is back in vogue in Canada with opposition leader Pierre Poilievre vowing to accelerate the approval of 10 key energy projects, including Suncor Energy’s 300,000 b/d Base Plant mine.

Copper Prices Collapse, Buyers Stock Up. In a rare occasion of extreme volatility, the plunging of copper prices below $8,500 per metric tonne in Monday early trading prompted Chinese buyers to maximize purchases, pushing the metal to a $1,000/mt rally in just two hours, the largest intraday move since 2009.

Wary of US Tariffs, Mexico Wants to Frack. Importing some 6.5 BCf/d of US pipeline gas and poised to import more as legacy fields decline, Mexico has reached out to private investors to expand domestic fracking operations, a policy reversal compared to Lopez Obrador years.

Gold Prices Recover Before Stock Market. Overcoming the past days’ market frenzy that triggered three consecutive daily declines, gold prices rose back above $3,000 per ounce on the back of a weakening US dollar and a worsening outlook on US-China tariff wars.

Saudi Arabia Contracts US LNG Volumes. US LNG developer NextDecade signed an offtake agreement with Saudi Arabia’s national oil firm Saudi Aramco (TADAWUL:2222) to supply 1.2 million tonnes LNG per year from Train 4 of Rio Grande LNG, subject to a positive FID decision soon.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com

- Job Numbers Rise in Alaska’s Arctic Thanks to Oil Projects

- Your Next iPhone Could Cost $2,300—But Oil Prices Might Stay Stuck

- Taiwan Invested $165 Billion. Trump Hit Back With Tariffs.